6 April 2020

Beyond the Credit Score. Open Banking solutions for thin file and other near-prime customers

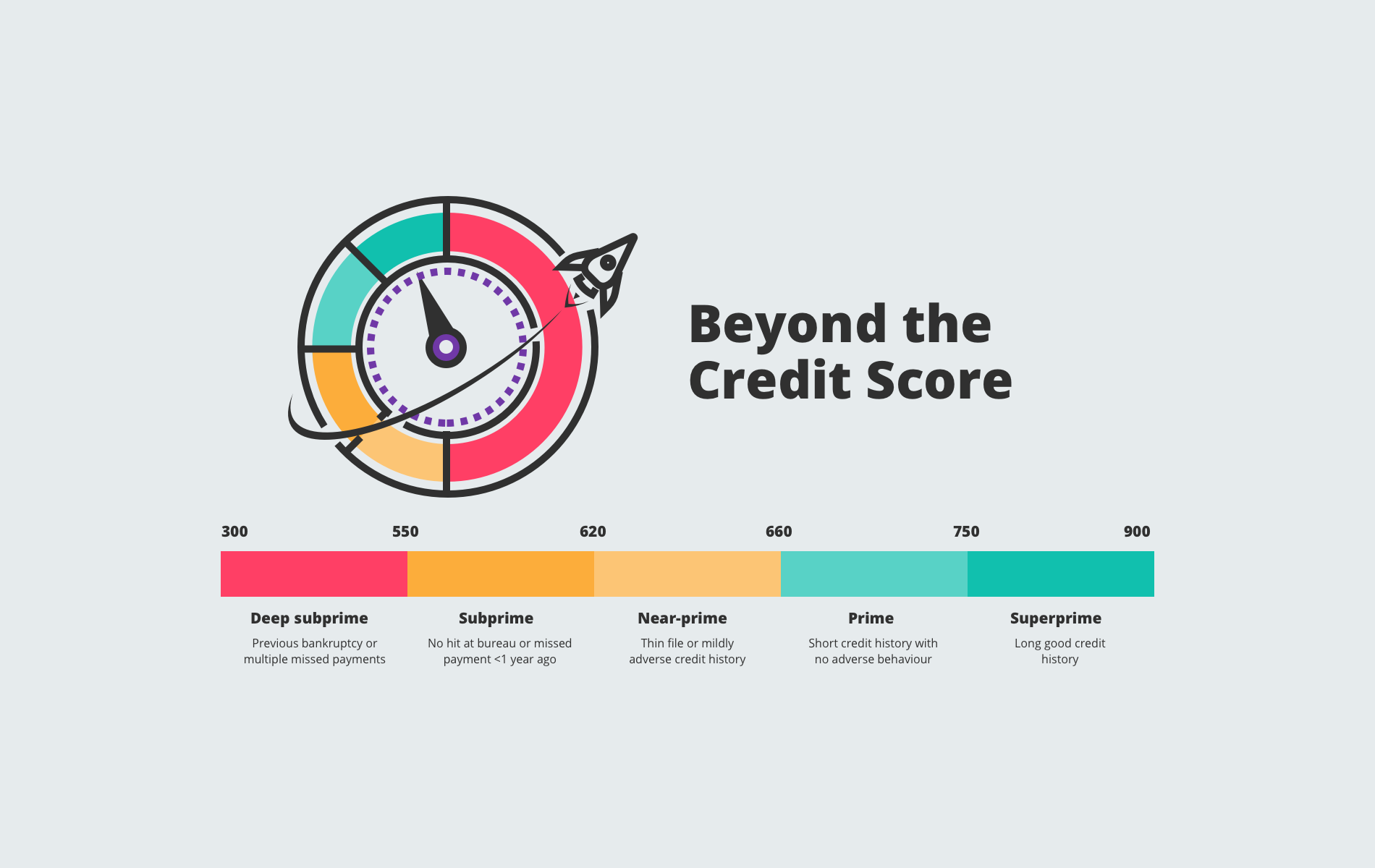

Credit scores have long been the benchmark for determining whether or not you are eligible for credit. Credit scores also determine the quality of credit you will receive: a higher score generally translates to lower interest rates. Whilst it is easy to determine the eligibility of individuals at either end of the scoring spectrum, there exists a subset of customers in the middle known as “near-prime” for which things are less clear.