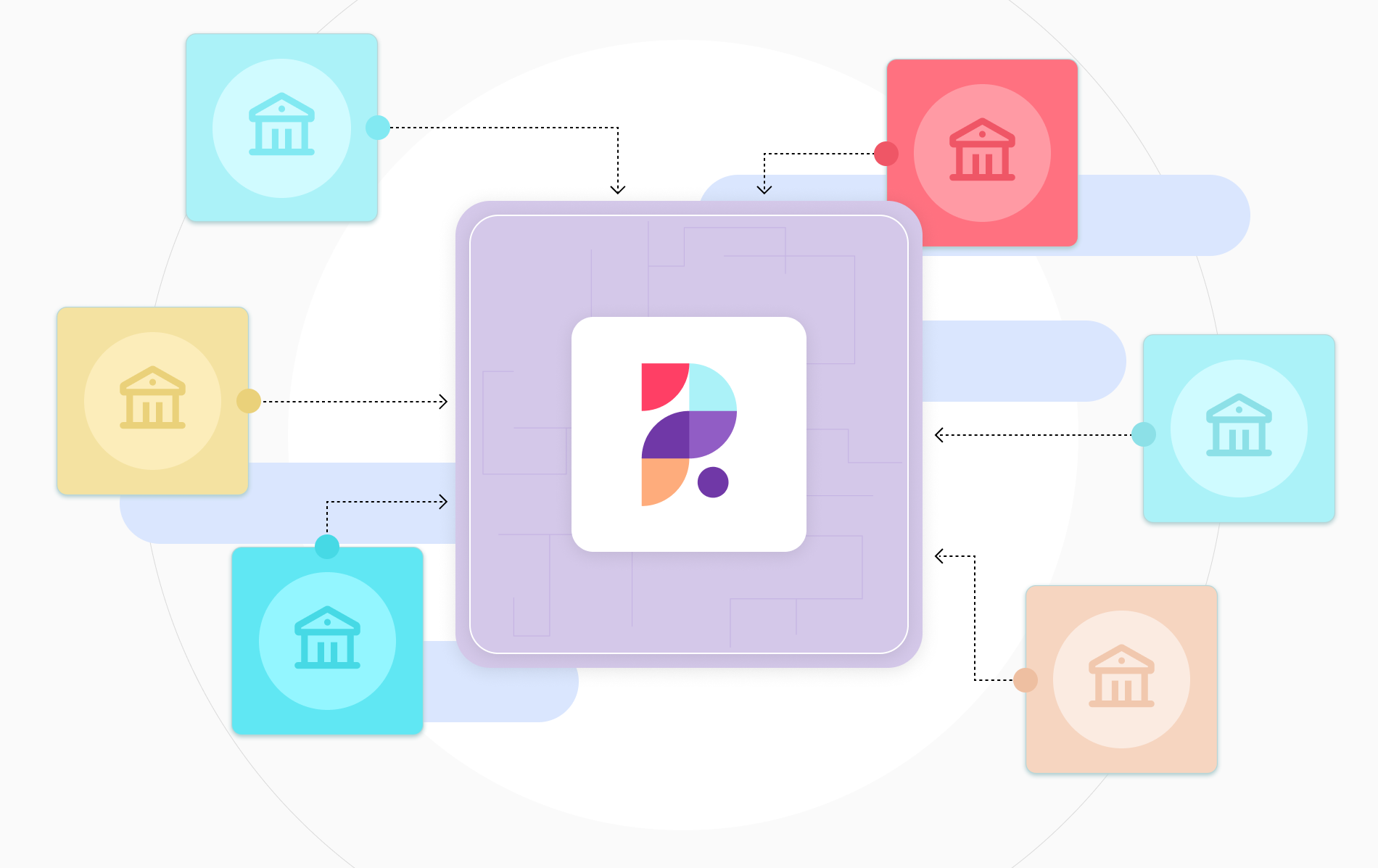

In the dynamic landscape of finance, the evaluation of creditworthiness stands as a cornerstone for lending institutions. Traditional methods, reliant on manual processes, have given way to a new era of precision and efficiency through automated credit decisioning engines. These innovative systems, exemplified by platforms such as Planky, are revolutionizing credit risk assessment by leveraging cutting-edge technology. Planky, a modern analytics tool that simplifies the fast and secure sharing of financial data via Open Banking, allows users to authorize their data sharing with their bank.

To understand the framework of credit decisioning and how it has reformed the credit-risk underwriting process, continue reading below.

What Is Credit Decisioning?

With the advent of automated credit decisioning software, or credit-risk decisioning, financial lenders have since begun utilizing a more streamlined underwriting process. It involves using advanced algorithms and data analytics to swiftly and accurately assess a credit applicant's creditworthiness. The goal is to simplify the evaluation and information-collection process by harnessing large amounts of data from various data sources, such as credit bureaus, to make sound lending decisions.

The Framework of Automated Decisioning Engines

These systems, regardless of the provider, typically share common attributes and functionalities. For ease of understanding their core capabilities and standard functions, here is a breakdown:

Data Utilization: Automated credit decisioning engines aggregate and analyze data from diverse sources, providing a comprehensive view of an applicant's financial profile.

Real-time Decisioning: They enable instant decisions by leveraging real-time data ingestion and analysis, reducing decision latency and enhancing customer experience.

Risk Management: Robust risk management tools are integral, allowing for comprehensive risk assessment and the formulation of effective mitigation strategies.

Machine Learning Integration: Many platforms incorporate machine learning algorithms, enabling continuous learning from data patterns to improve decision accuracy over time.

Why Companies Need Automated Credit Decisioning Engines

It goes without saying that in today's fast-paced economy, businesses need efficiency more than ever. As such, more and more financial institutions across the globe are adopting credit decisioning engines and finding the yielded results to be cost-effective and advantageous in enhancing accuracy in decision-making processes. Here is why they have become so popular:

Precision and Consistency: These platforms eliminate human biases and inconsistencies inherent in manual processes, ensuring a consistent and objective evaluation based on predefined criteria.

Speed and Efficiency: Automated decisioning engines significantly reduce decision-making time, enabling quicker loan approvals and enhancing customer satisfaction.

Risk Mitigation: By employing sophisticated risk assessment models, these systems effectively identify potential risks, aiding in better risk management strategies.

The Future Landscape

The future of automated credit decisioning engines holds immense promise. With the swift evolution of artificial intelligence, machine learning, and big data analytics, we can only expect further refinements in these systems. As a result, they will undergo enhancements in their predictive capabilities and accuracy. Here is what we predict in the realm of decisioning engines.

Predictive Analytics: The integration of predictive analytics will enable these engines to anticipate future trends and behaviors, facilitating proactive risk management strategies.

Enhanced Personalization: Continued development will enable a more personalized approach to credit assessment, catering to individual customer needs while maintaining risk parameters.

Ethical AI Implementation: With a focus on ethical AI, these systems will prioritize fairness, transparency, and accountability in decision-making processes.

The Top Private Players

The automated credit decisioning industry has expanded across public and private domains, making it an accessible underwriting alternative for financial institutions of all sizes and budgets.

Below is a list of some of a few notable private players:

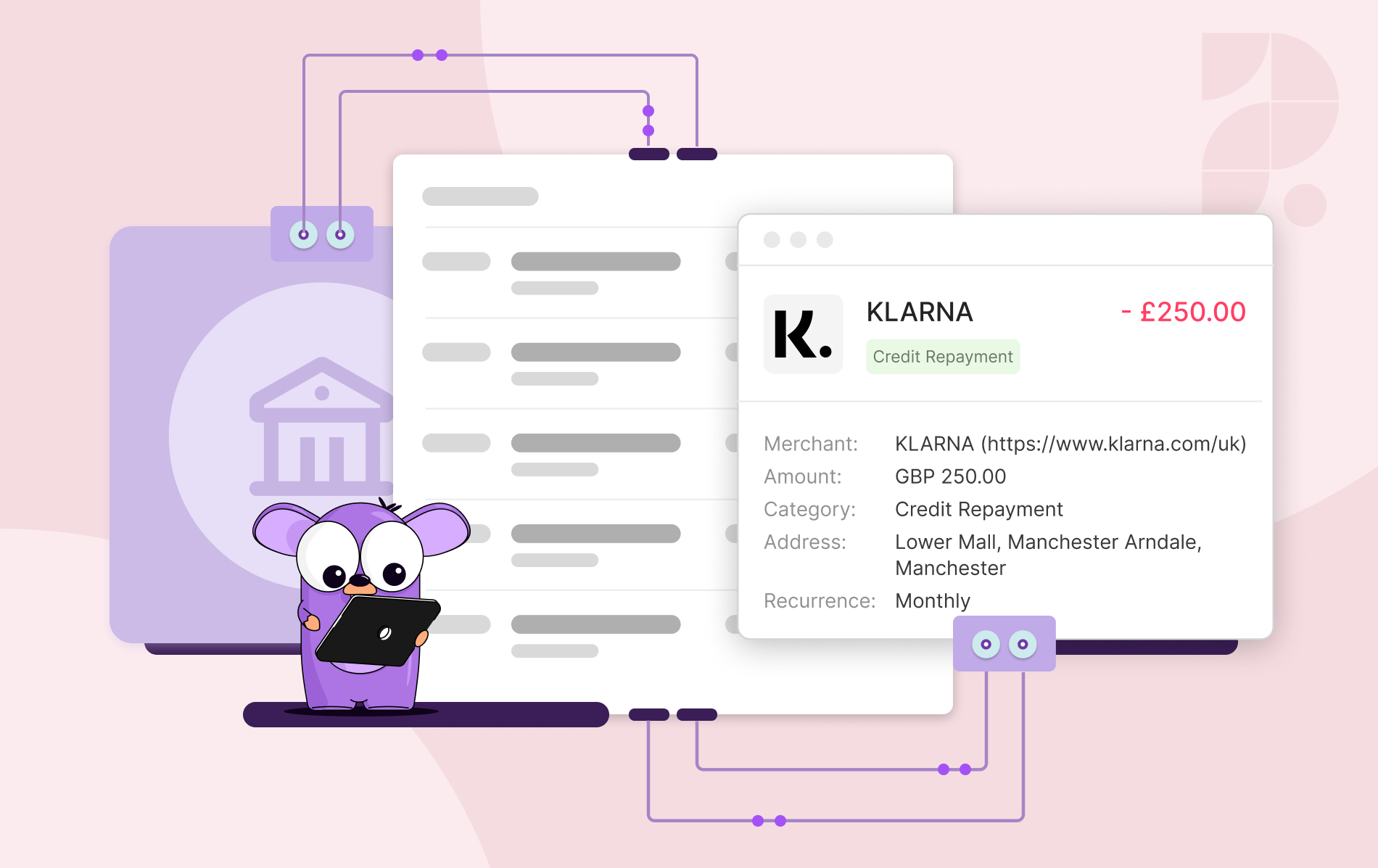

- Planky: Planky enables you to check the finances of your customers to instantly understand their spending habits and use this information to make smarter decisions. Unlike most automated credit decision platforms, Planky isn’t complex or hard to follow

- Zest AI: Zest AI is known for its machine learning-based credit decisioning platform that aims to provide more accurate and fair credit evaluations. It's a privately held company that has gained recognition for its innovative approach to credit risk assessment.

- Scienaptic Systems: This New York-based company offers a platform called Ether that employs AI and machine learning for credit underwriting and risk assessment. It specializes in alternative data analysis to improve credit decisioning.

- Provenir: Operating globally, Provenir offers a risk and decisioning platform that helps customers process financial operations efficiently. It’s a flexible SaaS solution using key data, AI, and risk decision capabilities that allow companies to stay ahead of financial risk.

- Alloy: Their platform allows customers to manage their credit decisions and automate credit checks. Alloy’s identity decisioning tool includes credit underwriting. The platform’s API allows financial institutions to collect customer information, credit bureau data, and alternative underwriting data through a single point of integration to quickly make data-driven credit decisions.

Conclusion

Automated credit decisioning engines represent a paradigm shift in the finance industry. They streamline credit risk assessment, paving the way for a more efficient, precise, and customer-centric lending ecosystem. As technology evolves, these systems will continue to play a pivotal role in shaping the future of finance, driving innovation while maintaining robust risk management frameworks.