15 April 2024

Transactions – how to make use of accurate, real-time data from a trusted source

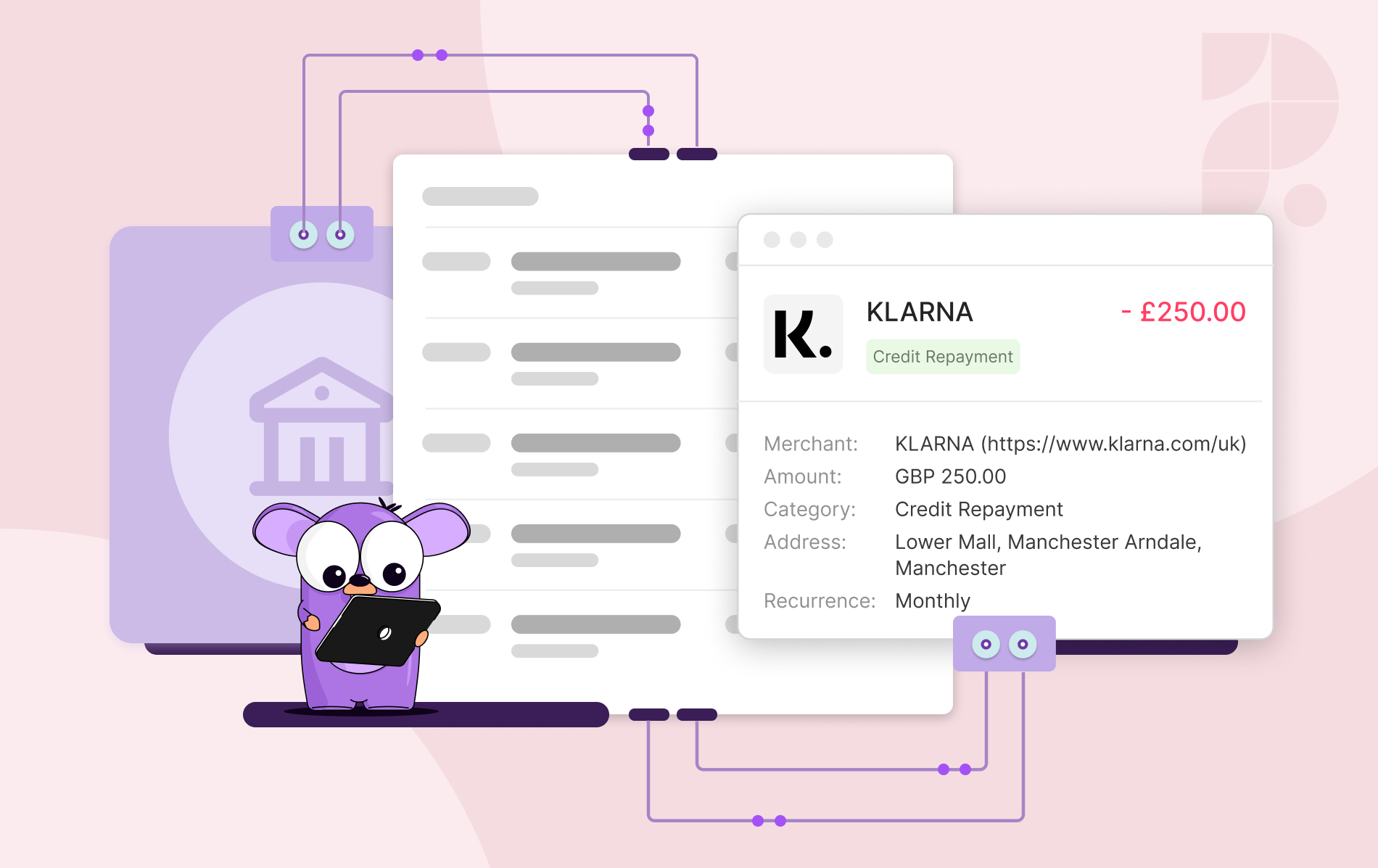

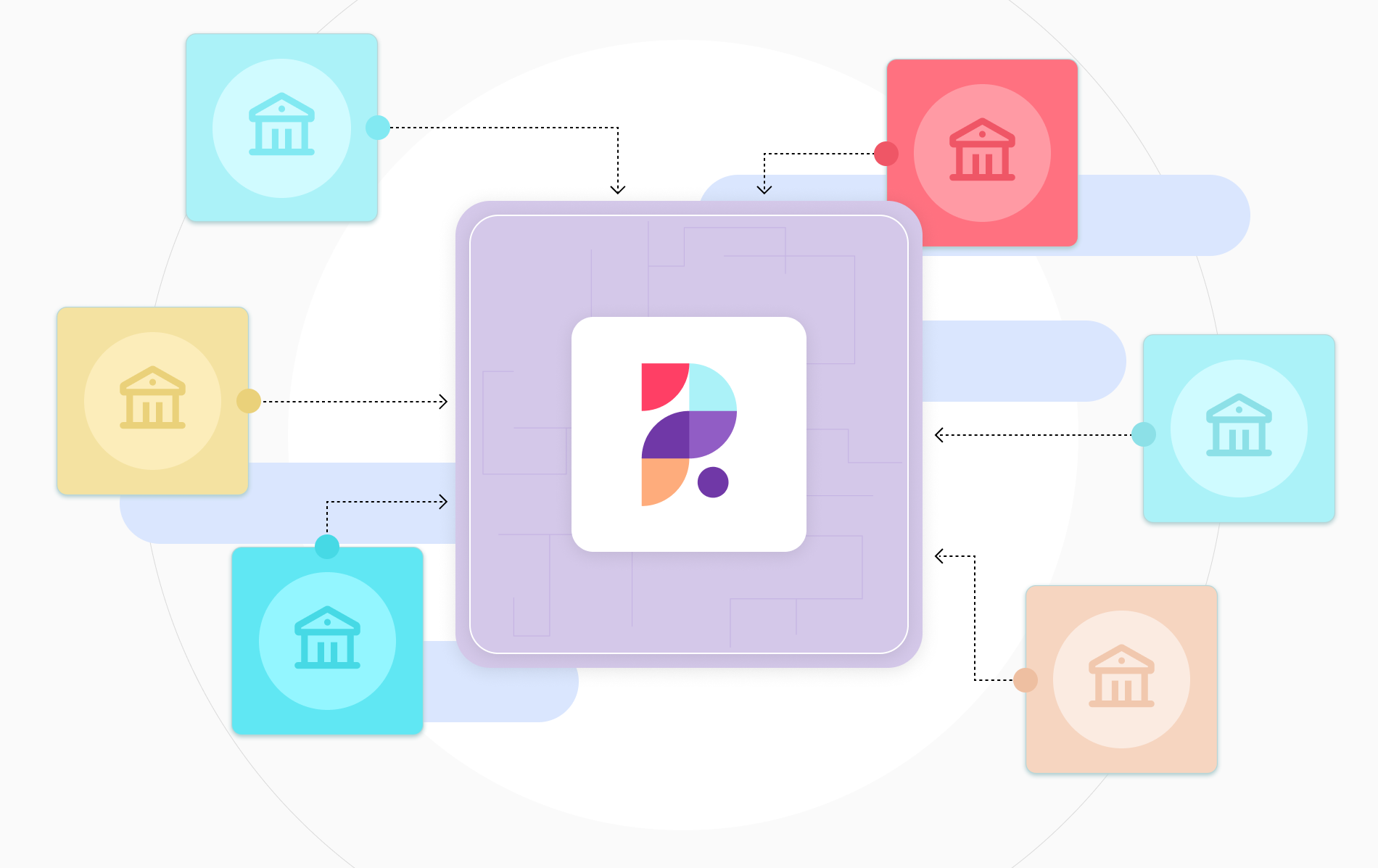

Having direct and instant access to a bank account is now a standard most customers couldn’t live without. However, businesses may struggle with collecting and verifying data that comes from various sources. This is where Planky’s Transaction comes in. The platform enables businesses to extract real-time transactional data from the bank in one click. Yes, in one click – this is a real game-changer if you want to benefit from instant account verification, improve customer experience, and save on costs.