When it comes to procedures that lenders need to conduct before approving a loan, income verification is probably the most important one. However, income verification is often time-consuming and error-prone, especially when you rely on traditional methods and manual processes. Before open banking, a potential client had to get verification from their own bank and present the verification to the lender. From a lender’s perspective, the process required analyzing tons of documents and looking for information about salary and the history of repayment. Thankfully, open banking has simplified income verification and analyses.

What income verification actually is?

Income verification is a crucial step in various financial processes, particularly when renting a property or securing a loan is in the game. In the past, the process involved presenting many documents to make sure that a potential applicant could pay for the item they are applying for. Those might be salary payment documents, tax returns documents, monthly bank statements, and more. At some point, it turned out that income verification needed simplifying. There was no standardization of the documents, and the risk of forgery was relatively high as physical documents are always vulnerable to fraud in the hands of a knowledgeable fraudster. Also, most documents were static which may be problematic in dynamic fields such as finance.

Today, modern businesses choose automatic income verification. It opens the door for faster and more efficient financial services. Using a straightforward system, a client can actually click on their bank provider and submit the correct login information. Lending companies, on the other hand, can easily and quickly connect with the bank using an API. The entire process takes seconds – you receive a lender’s income information instantly. There is no middleman in the process, so the lender knows that the information is accurate and untampered, delivered directly by the bank.

How Income Check works

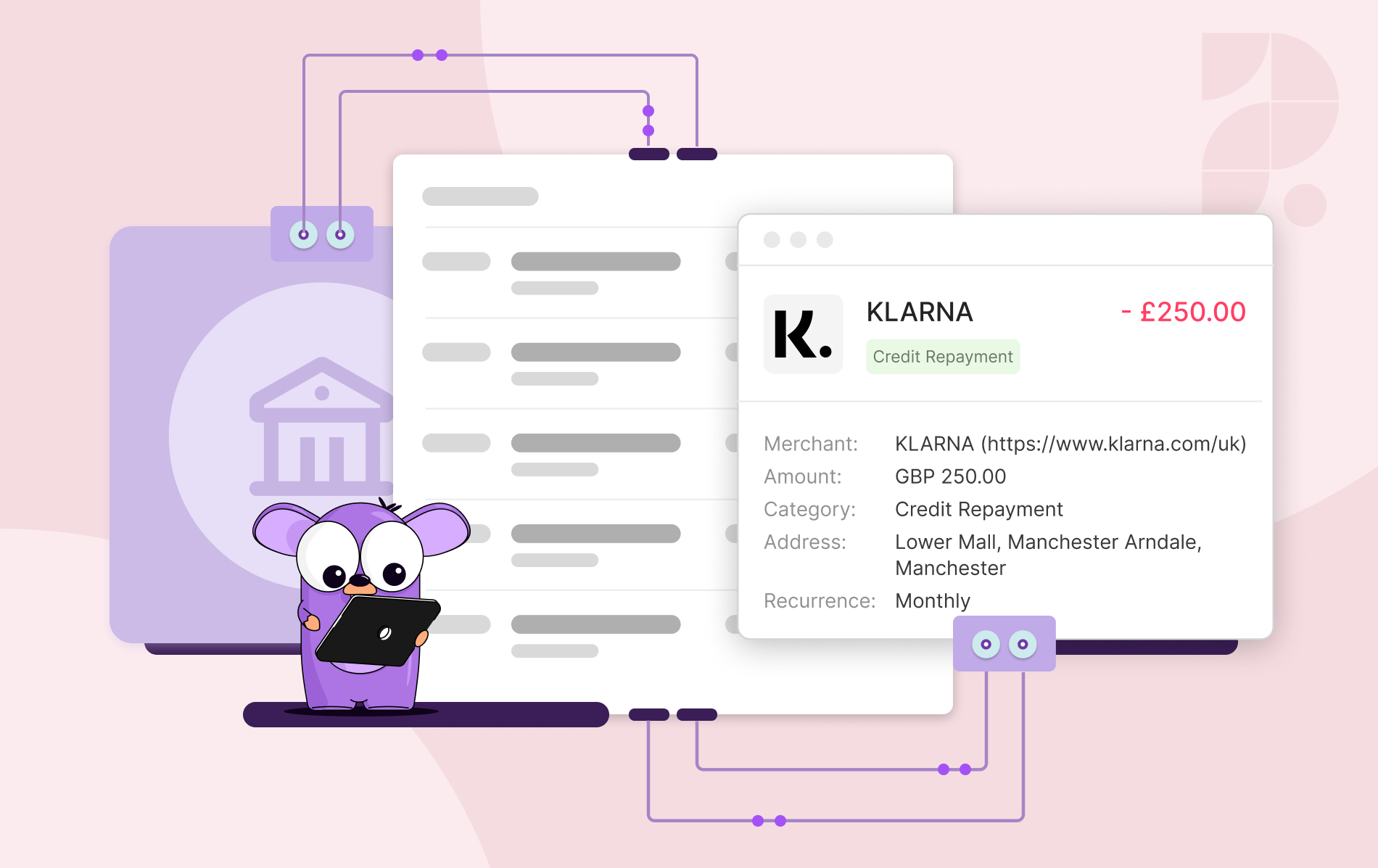

From a customer’s perspective, the entire process is extremely simple. First, a customer needs to grant permission to their bank accounts that receive income. Then, they need to select their income sources that are detected by the Planky app. Finally, the customer should review and allow the income information to be shared with the lender. As a result, the Planky platform provides the company with the selected income sources, as well as with metadata such as income stream category and frequency.

The process may seem to be quick and easy, however, there is a powerful mechanism behind it. The engine is powered by Artificial Intelligence and Machine Learning algorithms that extract insights from a user’s bank transactions. Here is how it works behind the scenes step by step:

1. Transactions are extracted from a user’s bank account. This can happen because Planky is connected with thousands of European banks and financial institutions.

2. Transactions are filtered so that those that aren’t income can be removed. Transactions marked as income are then clustered into similar source streams.

3. The frequency of income sources is detected to enable the credit decisioning process. The detection rate of the Planky app is over 95%.

4. Income is identified and categorized into several income categories. This final step enhances the quality and reliability of data.

Open banking and Income Check – it’s a match!

Open banking has revolutionized the way businesses verify income verification. It grants lenders instant and fully secure access to customer account information as long as they have the customer’s consent.

The most important benefits of open-banking-supported Income Check:

1. You get instant access to complete income information. In the past, it was difficult to analyze the income of freelancers, people working abroad, or making extra income from the ‘gig economy’. With Income Check, you get a full overview of all the incoming cash flows to make better loaning decisions.

2. You can go far beyond traditional income verification. On top of just income information such as the income source, you can also track spending habits, trends, and risk appetite. Such information enables you to build predictive models, assess risk, and make informed decisions regarding your users’ current and future financial statuses.

3. Income Check helps you increase customer conversion rates. It is easier for your customers to proceed with the credit assessment processes.

4. Income Check boosted by open banking is extremely safe thanks to APIs designed and built by the banks. They ensure that the lender is approved and authorized.

5. The credit assessment process is better and more reliable. This is mainly because you can gather relevant information from a longer period of time than traditional reference checks.

6. You save on operational costs. There are savings in both time and resources.

7. Open banking in income verification removes any opportunity for fraud as through APIs, direct access is made with an applicant’s bank account. It’s also easier for you to assess credit risk.

Planky can help in better loan underwriting

Account Income may be a huge step towards streamlining your income verification processes. As a lender, you can quickly and accurately get reliable income data from your customers’ bank transactions and verify a potential borrower’s income sources and spending habits.

Interested in trying out an end-to-end solution that speeds up income verification and helps you make the most out of income data? Book a demo and start using the Planky platform right away!